𝐁𝐞𝐲𝐨𝐧𝐝 𝐭𝐡𝐞 𝐓𝐚𝐫𝐢𝐟𝐟: 𝐖𝐡𝐚𝐭 𝐑𝐞𝐚𝐥𝐥𝐲 𝐒𝐡𝐚𝐩𝐞𝐬 𝐚 𝐁𝐄𝐒𝐒 𝐁𝐢𝐝

While many are busy debating the final tariffs in the recent 𝐌𝐒𝐄𝐃𝐂𝐋 𝐁𝐄𝐒𝐒 𝐭𝐞𝐧𝐝𝐞𝐫, comparing it with the 𝐑𝐕𝐔𝐍𝐋 𝐛𝐢𝐝 is like comparing apples to oranges. Each tender has its own structure, assumptions, and risk contours — and direct comparison only distorts perspective.

The 𝐑𝐕𝐔𝐍𝐋 𝐛𝐢𝐝 was designed for a 𝟐-𝐡𝐨𝐮𝐫, 𝟐-𝐜𝐲𝐜𝐥𝐞 𝐬𝐲𝐬𝐭𝐞𝐦 with 𝟏𝟑𝟐𝐤𝐕 𝐨𝐫 𝟐𝟐𝟎𝐤𝐕 𝐜𝐨𝐧𝐧𝐞𝐜𝐭𝐢𝐯𝐢𝐭𝐲, where the 𝐥𝐚𝐧𝐝 𝐚𝐧𝐝 𝟏.𝟓–𝟐 𝐤𝐦 𝐭𝐫𝐚𝐧𝐬𝐦𝐢𝐬𝐬𝐢𝐨𝐧 𝐥𝐢𝐧𝐞 had to be arranged by the bidder. In contrast, the 𝐌𝐒𝐄𝐃𝐂𝐋 𝐭𝐞𝐧𝐝𝐞𝐫 was for a 𝟐-𝐡𝐨𝐮𝐫, 𝐬𝐢𝐧𝐠𝐥𝐞-𝐜𝐲𝐜𝐥𝐞-𝐩𝐞𝐫-𝐝𝐚𝐲 𝐬𝐲𝐬𝐭𝐞𝐦 with auxiliary consumption, 𝟑𝟑𝐤𝐕 𝐜𝐨𝐧𝐧𝐞𝐜𝐭𝐢𝐯𝐢𝐭𝐲 𝐚𝐧𝐝 𝐥𝐚𝐧𝐝 𝐩𝐫𝐨𝐯𝐢𝐝𝐞𝐝 𝐛𝐲 𝐌𝐒𝐄𝐃𝐂𝐋 — a structure that inherently reduces capex, simplifies execution, and extends asset life (close to 20 years). Even the auxiliary consumption (𝐰𝐡𝐢𝐜𝐡 𝐢𝐬 𝐚 𝐦𝐚𝐣𝐨𝐫 𝐩𝐨𝐰𝐞𝐫 𝐝𝐫𝐚𝐢𝐧𝐞𝐫) falls under the scope of MSEDCL.

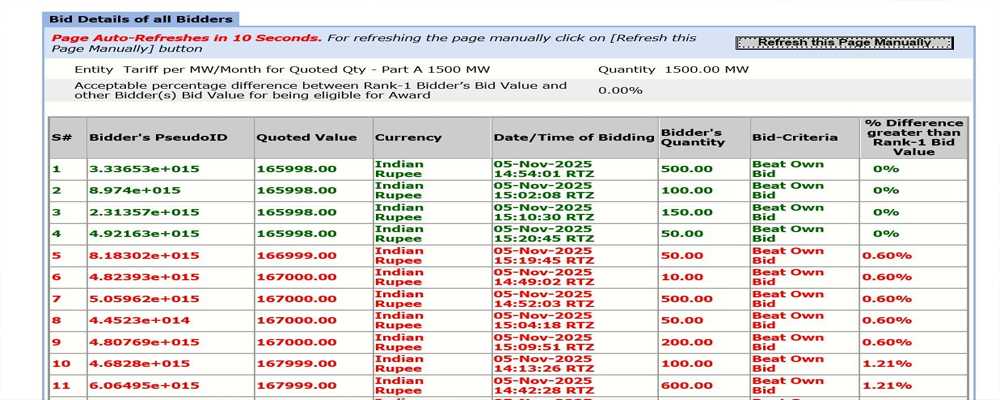

If you look closely, the ₹𝟏.𝟔𝟓 𝐥𝐚𝐤𝐡/𝐌𝐖/𝐦𝐨𝐧𝐭𝐡 𝐭𝐚𝐫𝐢𝐟𝐟 𝐢𝐧 𝐌𝐒𝐄𝐃𝐂𝐋 is actually more attractive than ₹𝟏.𝟕𝟖 𝐥𝐚𝐤𝐡/𝐌𝐖/𝐦𝐨𝐧𝐭𝐡 𝐢𝐧 𝐑𝐕𝐔𝐍𝐋, especially considering the 𝟏𝟒%+ 𝐈𝐑𝐑 𝐢𝐧 𝐌𝐒𝐄𝐃𝐂𝐋 𝐯𝐞𝐫𝐬𝐮𝐬 𝐬𝐢𝐧𝐠𝐥𝐞-𝐝𝐢𝐠𝐢𝐭 𝐫𝐞𝐭𝐮𝐫𝐧𝐬 in the latter. Our own internal benchmarks were ₹1.70 Lakh/MW/Month as the first cut, ₹1.65 Lakh as the second, and ₹1.62 Lakh as the final threshold (final “take-it-or-leave-it” threshold).

Too often, we get anchored to historical numbers and lose sight of context. It’s like comparing 𝐍𝐇𝐏𝐂/𝐒𝐄𝐂𝐈 𝐈𝐒𝐓𝐒 𝐒𝐨𝐥𝐚𝐫 + 𝐁𝐄𝐒𝐒 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐬 with 𝐑𝐔𝐌𝐒𝐋’𝐬 𝟔𝟎𝟎𝐌𝐖 + 𝟒𝟒𝟎𝐌𝐖𝐡 𝐒𝐨𝐥𝐚𝐫 + 𝐒𝐭𝐨𝐫𝐚𝐠𝐞 or 𝐔𝐏𝐏𝐂𝐋’𝐬 𝐬𝐭𝐚𝐧𝐝𝐚𝐥𝐨𝐧𝐞 𝐁𝐄𝐒𝐒 (𝐰𝐡𝐢𝐜𝐡 𝐢𝐬 𝐞𝐟𝐟𝐞𝐜𝐭𝐢𝐯𝐞𝐥𝐲 𝐒𝐨𝐥𝐚𝐫 + 𝐁𝐄𝐒𝐒). Each tender has its own 𝐭𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥 𝐚𝐫𝐜𝐡𝐢𝐭𝐞𝐜𝐭𝐮𝐫𝐞, 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐨𝐛𝐥𝐢𝐠𝐚𝐭𝐢𝐨𝐧𝐬, 𝐚𝐧𝐝 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐬𝐞𝐧𝐬𝐢𝐭𝐢𝐯𝐢𝐭𝐢𝐞𝐬 and the tariff is merely a reflection of those underlying realities.

The 𝐤𝐞𝐲 𝐭𝐚𝐤𝐞𝐚𝐰𝐚𝐲: Every bid must be evaluated on its 𝐨𝐰𝐧 𝐭𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥 𝐚𝐧𝐝 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐦𝐞𝐫𝐢𝐭𝐬, not just the headline tariff. Otherwise, we risk 𝐥𝐨𝐬𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐬𝐭 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐭𝐫𝐞𝐞𝐬.

In energy storage, context isn’t optional, it’s everything.